Accumulated depreciation formula balance sheet

Accumulated Depreciation Balance Sheet Sample will sometimes glitch and take you a long time to try different solutions. Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years.

Accumulated Depreciation Definition Formula Calculation

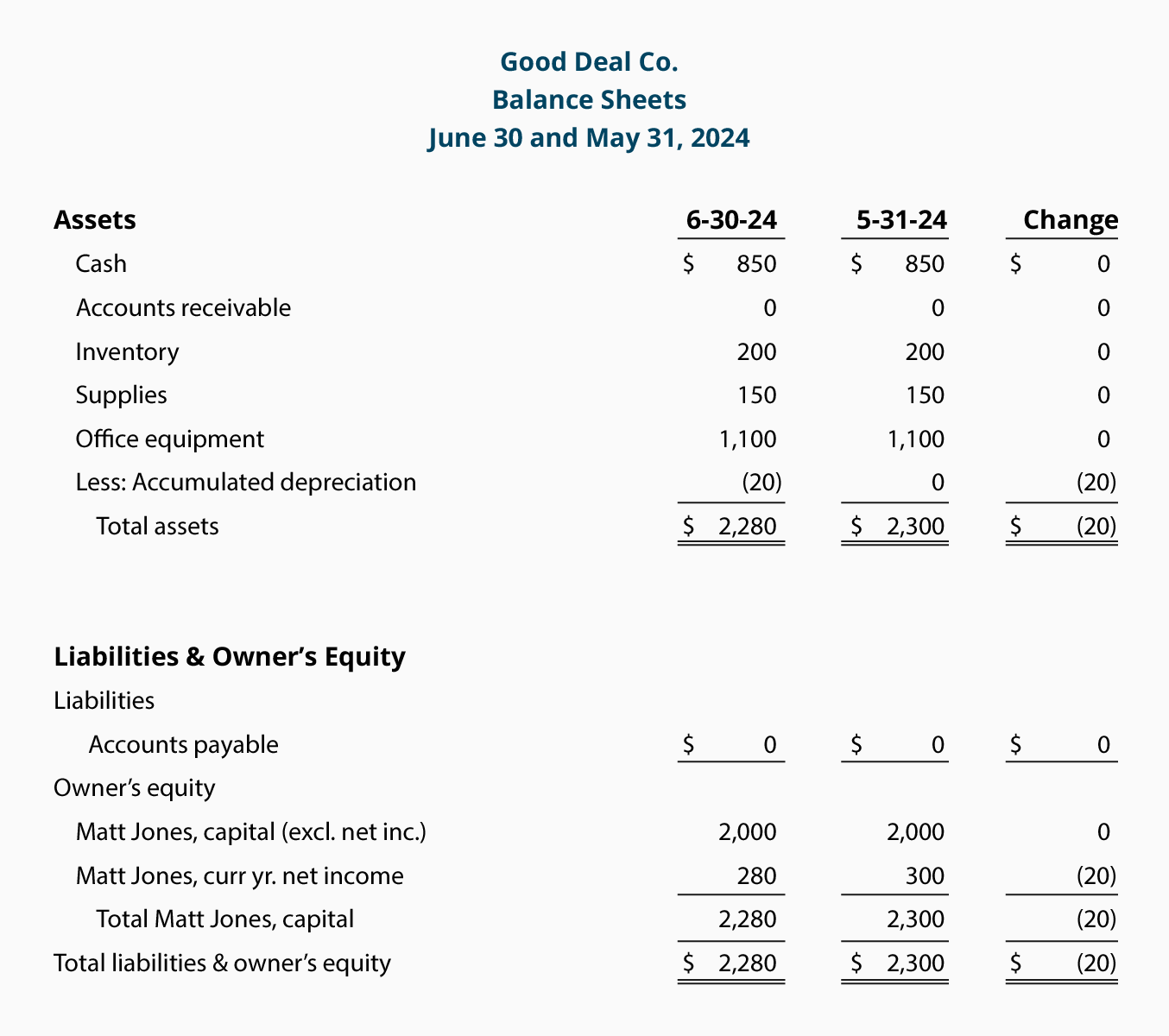

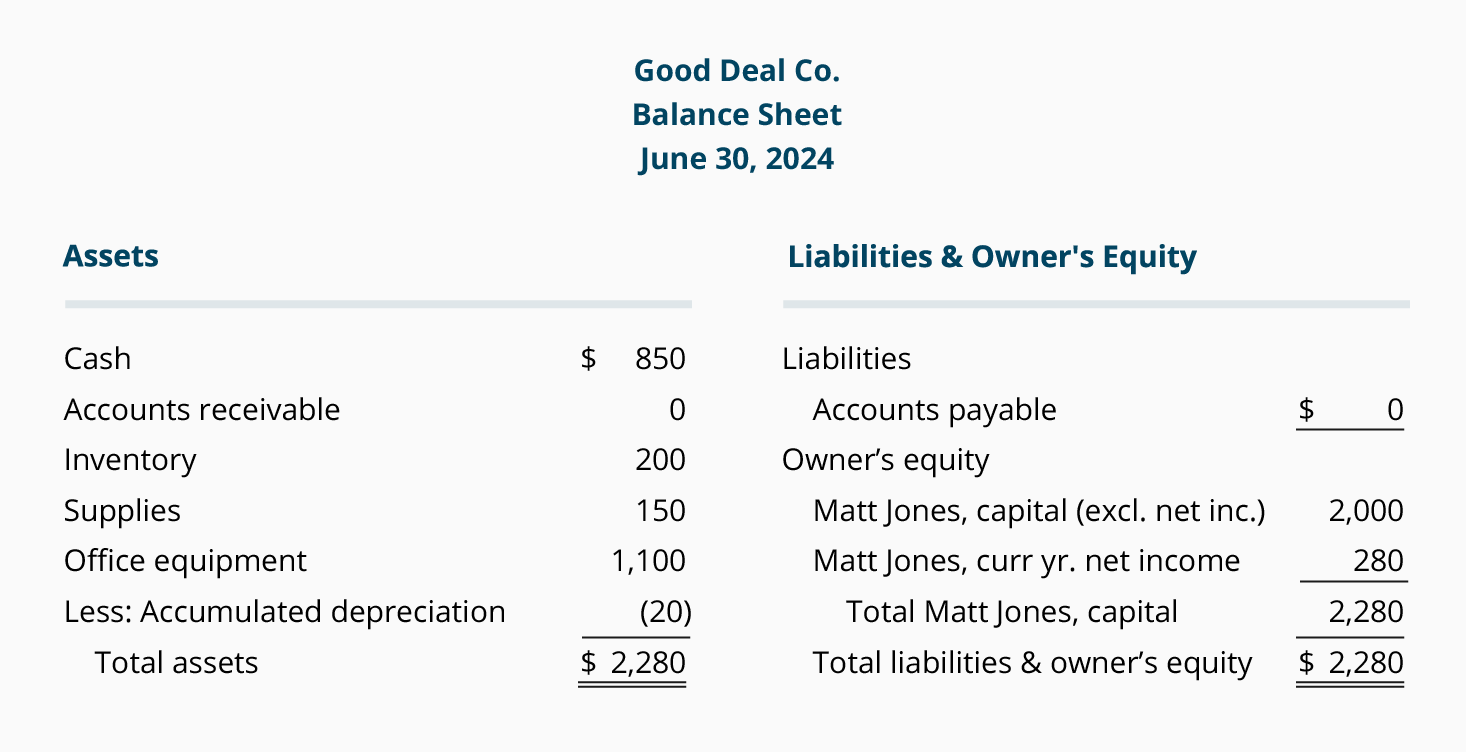

The formula for net book value is cost an.

. Double declining balance depreciation 2x straight-line depreciation rate x remaining book value Read more. Recording Accumulated Depreciation. Use a depreciation factor of two when doing calculations for double dec.

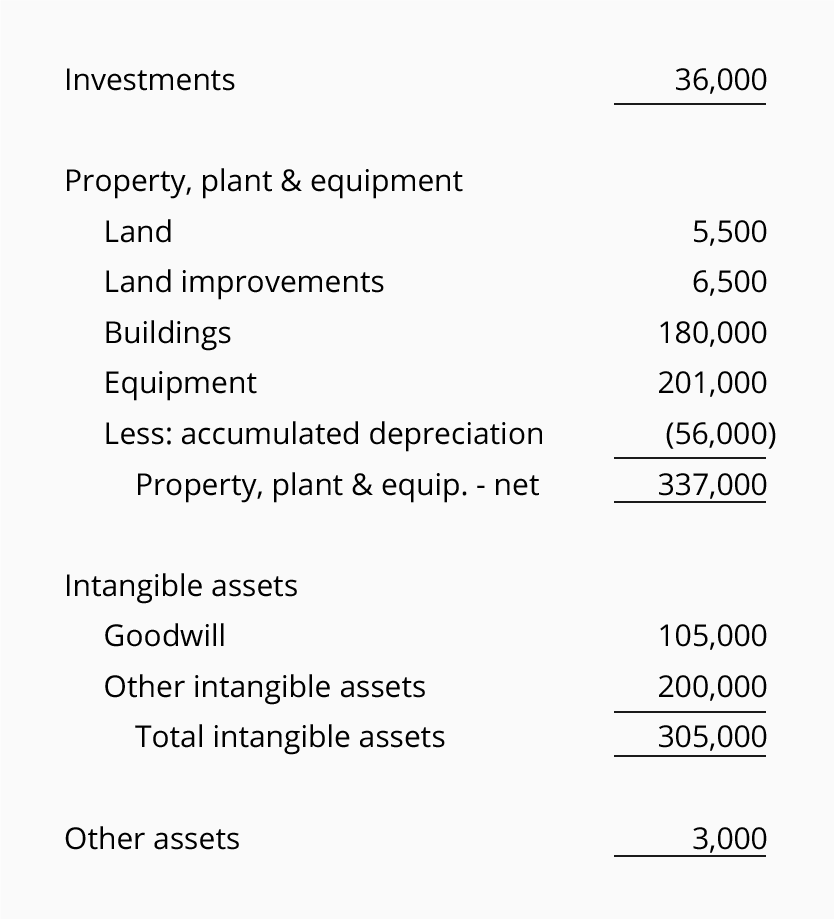

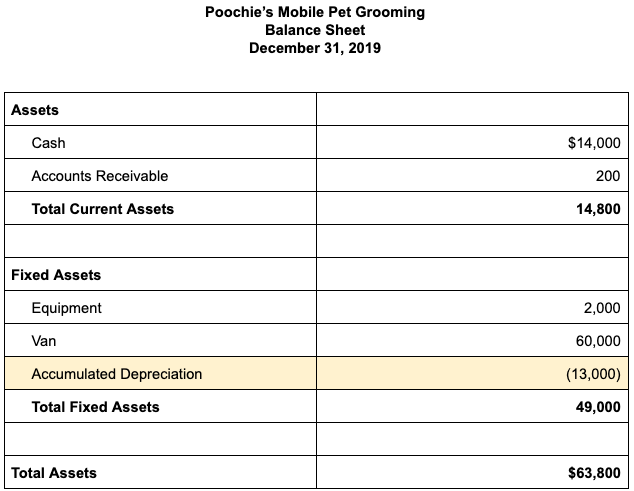

Accumulated depreciation is used to calculate an assets net book value which is the value of an asset carried on the balance sheet. Total yearly depreciation Depreciation factor x 1. Accumulated depreciation formula after 3 rd year Acc depreciation at the start of year 3 Depreciation during year 3 40000 20000 60000 Example 2.

Accumulated Depreciation On Balance Sheet will sometimes glitch and take you a long time to try different solutions. Accumulated depreciation of an asset is an important financial metric for the. Lets say you have a car used in your business that has a value of 25000.

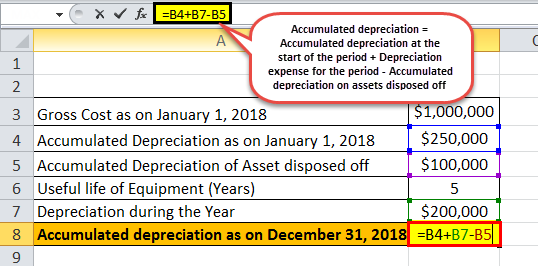

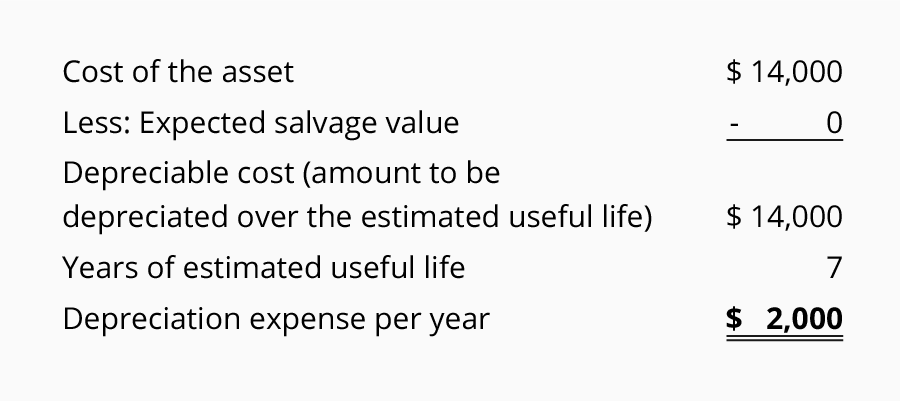

LoginAsk is here to help you access Accumulated Depreciation. Depreciation Expense and Accumulated Depreciation. Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years.

Accumulated depreciation is the total amount of depreciation assigned to a fixed asset over its useful life. The formula for calculating straight-line depreciation is as follows. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is.

You can use the following basic declining balance formula to calculate accumulated depreciation for years. The formula for accumulated depreciation under the straight-line method may look as follows. The building is expected to be.

Read more about Bank reconciliation statement. Ad Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More. It depreciates over 10 years so you can take.

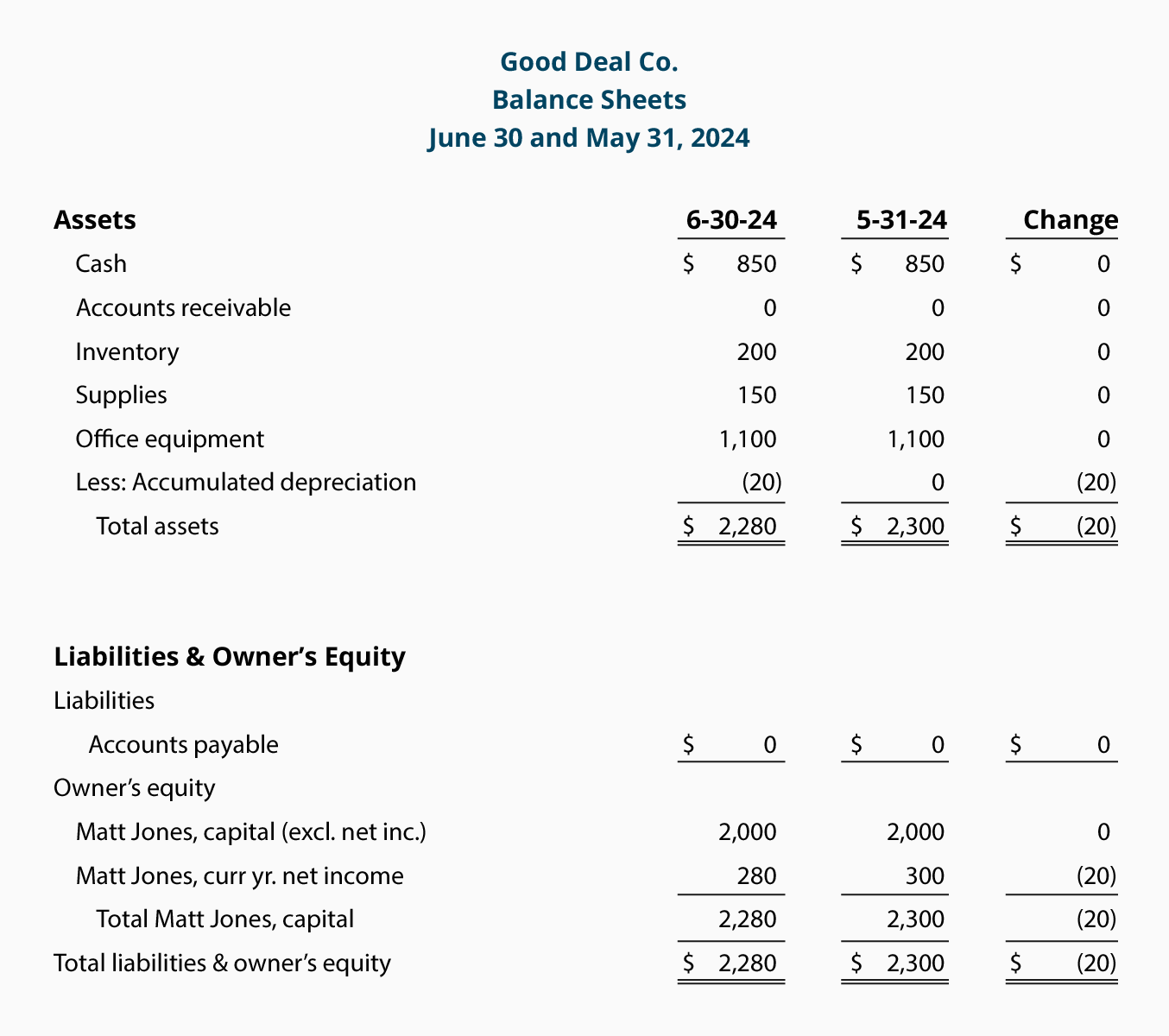

Therefore the calculation after 1 st year will be Accumulated depreciation formula after 1 st year Acc. Since accumulated depreciation is a credit the. On the balance sheet the carrying.

Accumulated Amortization Amortized Asset Value Per Year. Using the some of years method formula the companys bookkeeper calculates the accumulated depreciation to add it to the companys balance sheet. LoginAsk is here to help you access Accumulated Depreciation On A.

The formula for double declining balance depreciation is. Imagine Company ABC buys a building for 250000. Asset cost Expected salvage value Useful life x Years in use.

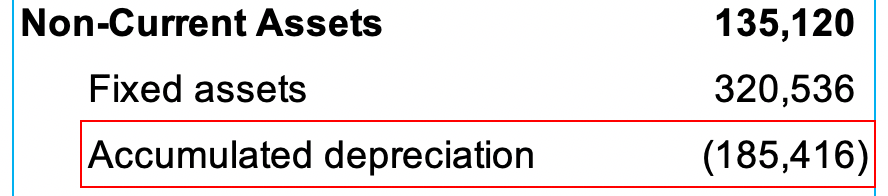

On December 31 2017 what is the balance of the accumulated depreciation account. Subtract the accumulated depreciation on the prior accounting periods balance sheet from the accumulated depreciation on the most recent periods balance sheet to calculate the. Fixed assets are recorded as a debit on the balance sheet while accumulated depreciation is recorded as a creditoffsetting the asset.

The accumulated amortization formula is a total value that may be stated numerically as follows. 100000 20000 8 10000 in depreciation expense per year Download the. For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD. Once you own the van and show it as an asset on your balance sheet youll need to record the loss in value of the vehicle each year. Accumulated Depreciation On A Balance Sheet will sometimes glitch and take you a long time to try different solutions.

LoginAsk is here to help you access Accumulated Depreciation On Balance.

Balance Sheet Long Term Assets Accountingcoach

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Expense Depreciation Expense Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

Depreciation Expense Double Entry Bookkeeping

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Expense Depreciation Expense Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Explained Bench Accounting

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Calculation Journal Entry Accountinguide